Making Money in the 4K/UHD Ecosystem

, Posted in: Inspiration, Author: nleavitt (October 23, 2013)

Mass market deployment of 4K/UHD is not going to happen overnight.

But as the ecosystem matures, the potential is huge. Futuresource Consulting for instance, estimates that 4K TV sets will increase from 62,000 units last year to almost 800,000 by year’s end – and skyrocket to about 22 million units by 2017.

But there are a number of potential bumps in the road. As reported in TechZone 360, a number of operator challenges must be surmounted.

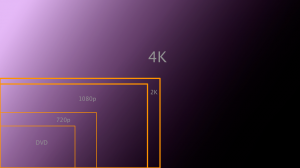

“Delivery of 4K requires four times the bandwidth of 1080p, which has significant implications for the production and distribution chains,” said Adam Cox, head of broadcast equipment at Futuresource.

While tools like HEVC (High Efficiency Video Coding) compression can mitigate some of the delivery overhead for pay-TV providers, one factor that’s affecting 4K investment added TechZone 360, is “a lack of an accepted broadcasting and transmission standard that meets the defined UltraHD TV spec and a current lack of 4K content – a big obstacle to the adoption of 4K TV sets and general uptake by consumers.”

No surprise then, that a panel of experts who recently sat down at the Society of Motion Picture and Television Engineers (SMPTE) 2013 Symposium in Hollywood, offered further insights on key issues and challenges that will drive how 4K/UHD is accepted by the marketplace. SMPTE is the technical society for the motion imaging industry, founded in 1916. Members are spread throughout 64 countries worldwide.

Entitled, ‘Who Will Make Money in the 4K Ecosystem,’ the panel was moderated by entertainment industry veteran Marty Shindler, who heads up Los Angeles-based The Shindler Perspective, an entertainment/entertainment technology management consulting firm.

Panelists included:

- Peter McGuinness, Director of Multimedia Technology Marketing, Imagination Technologies

- Tom Adams, Senior Principal Analyst, US Media, IHS

- Bryan Burns, President/CEO, The Forward Direction Group

- Peter Keith, VP/Senior Research Analyst, Piper Jaffray

The panelists discussed a wide array of business-centric issues – who will profit in the 4K ecosystem, what could delay implementation, who are the suppliers making investments, who’s active in the 4K value chain, and more.

”It will take a substantial investment in infrastructure before 4K makes a significant penetration into homes,” said Adams. “And it’s all about image – if your product looks great in 4K, advertisers will get behind the technology.”

And sports, added Burns, is likely to be one of the genres most likely to be captured in 4K because it has such uniform and commercial appeal. But he added a caveat that widespread acceptance could take longer because the major networks have yet to convert all their trucks to HD. In fact, one panel session attendee from a well-known sports network said he didn’t think it would be possible for them to get the content from the truck to the station because they are still using JPEG 2000 (an image compression standard and coding system) for insertion quality – right now they just don’t have the bandwidth for that if they convert to UHD.

Imagination’s McGuinness said it’s inevitable that 4K will be available on handsets and tablets, eventually allowing people to generate their own content.

“This will drive demand for them to also replace their TV sets, therefore the mobile arms race is actually going to drive adoption, not the TV networks,” he said.

McGuinness added that‘s where H.265 comes in – the codec is designed to utilize substantially less bandwidth thanks to advanced encoding techniques and a more sophisticated encode/decode model. It was also built to match the capabilities of future screens and includes support for 10-bit color and high frame rates.

On the retail front, it will be a few years before TV set manufacturers will make any money, said Keith.

“People like to show off their TVs – as prices come down, we’ll see an uptick in interest. We’re also seeing more unilateral pricing policies from brick and mortar and online companies like Costco, Best Buy and Amazon, so as prices come down in a controlled fashion, this will help sell 4K TVs to consumers,” said Keith.

And the bottom line?

The panellists were in agreement that upgrading to 4K will be a major investment not only from a technology infrastructure perspective, but for the consumer as well – manufacturers will have to pitch an effective use case to end users that 4K is the next cool thing.

Comments