Feature Story

More feature stories by year:

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

Return to: 2019 Feature Stories

Return to: 2019 Feature Stories

CLIENT: EVOQUE DATA CENTER SOLUTIONS

May 7, 2019: DataCenter Knowledge

The new operator is turning the telco's former colo business network-neutral, updating the facilities, and eyeing expansion.

In the first full quarter of its existence, Evoque Data Center Solutions has taken the first key steps to turning the old AT&T data center portfolio into a carrier-neutral colocation business and managed to secure a few new customers. According to executives, the five-month-old company hit the milestones they had set out to hit. However, everything did not go smoothly.

Inside the 31 data centers investor Brookfield Infrastructure Partners bought from AT&T at the start of the year (the deal closed in January) were 1,100 or so colocation customers. Brookfield formed Evoque to operate and grow the colo business. When Evoque staff started contacting customers in the initial weeks, many weren’t aware the $1.1 billion deal had taken place, Evoque CEO Tim Caufield told Data Center Knowledge.

“I you were one of their larger accounts, with dedicated account teams, those teams notified you of the transaction,” Caufield said. “But if you were the rank-and-file that represented the bulk of our 1,100 customers, unless you happened to catch [the AT&T press announcement], it was easy for you to miss the transaction.”

Once it became clear that AT&T hadn’t notified many of its customers about the sale, the telco helped with outreach, using its call center and sending out email blasts, he said. “Probably within about six weeks, that noise pretty much went down to zero,” Caufield said. “Since then, we’ve had very good engagement with our base.”

An AT&T spokesperson did not respond to a request for comment.

With the first full quarter under their belt, Evoque executives this week updated us on the progress to date and their next set of priorities.

Besides getting customers familiar with their new data center provider, much of the focus during the quarter was on making the footprint carrier-neutral. The 18 American facilities now have new network meet-me rooms, where customers can more easily connect to carriers or other networks in those facilities by buying cross-connects from Evoque.

While there had been other carriers in the facilities, there weren’t many. AT&T didn’t make it easy for customers to use the others. The former landlord would decide on a case-by-case basis whether to allow a customer to use another network provider, Caufield said.

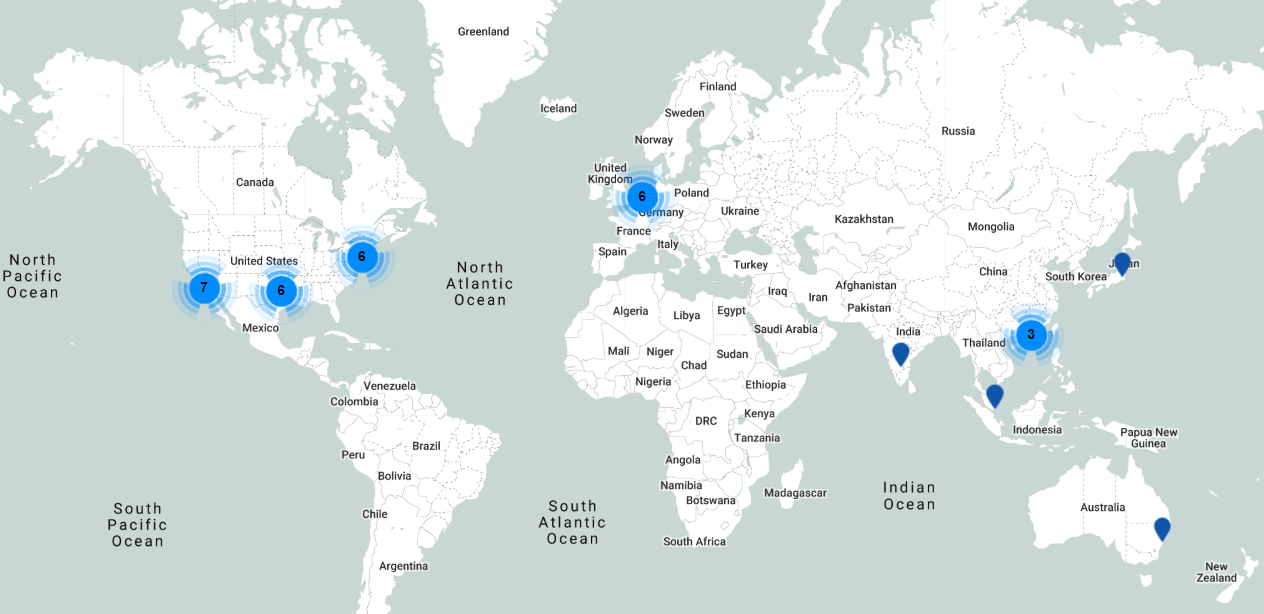

Evoque data center locations as of May 2019 (Source: Evoque/Google Maps)

Evoque has been actively courting more network operators. “We have not had any problem attracting the carriers,” Caufield said. “I would say there’s a wide degree of interest [among carriers in] getting into the facilities.”

The executives said they had signed about three new carriers but were only allowed to name one. Cogent Communications will be extending its network to four Evoque locations, Donna Henderson, Evoque’s chief marketing officer, told us.

They also said a major global SDN fabric operator had agreed to bring its virtual connectivity services to Evoque facilities but couldn’t disclose the name of the operator.

The executives have been in talks with the largest hyperscale cloud providers about bringing private network onramps to their platforms into Evoque data centers. Hosting cloud onramps has become an essential part of a modern data center provider’s value proposition.

Caufield said sales momentum in the first quarter was strong. He wouldn’t share specific numbers but said he was “pleased to see the amount of engagement that we had both with the existing base of customers as well as net new customers.”

“We did sign net new customers,” he said, but “it was not a ton.”

The former AT&T assets were generating about $300 million in annual revenue at the time of the sale, Caufield told us then.

Generally, Evoque sales staff have been more engaged with customers than those customers have been used to, Henderson said, with their inquiries addressed within hours rather than weeks, for example.

Colocation was part of a huge portfolio of services in the AT&T sales team’s toolkit, Henderson said. Support from a dedicated colocation team they have now is already a lot more than the telco’s customers had in the last three to five years, she said.

One of those customers – the biggest one – is AT&T itself. The telco continues providing a variety of enterprise IT services, using the same data centers to support them. It occupies about 15 percent of the footprint, Caufield told us when Evoque was launched. Evoque and AT&T also sell each other’s services.

Besides continuing to build out meet-me rooms (there are 13 data centers in Europe and Asia in addition to the US footprint) and getting more carriers to come onboard, Evoque is planning a series of physical upgrades to the facilities, which by today’s standards are older.

The planned upgrades include everything from cosmetic “facelifts” and better customer amenities to critical power and cooling infrastructure improvements.

In terms of critical infrastructure, the “big push for this year is around the batteries, capacitors, all the things that we want to do to make sure that we keep the lights on,” he said. Evoque is continuing the process of assessing the total amount of capital investment it will have to make to bring infrastructure across the portfolio up to date.

The first in line for “cosmetic enhancements” will be the Redditch, UK, data center. Built in the early 2000s, it is one of the oldest in the portfolio, according to Caufield.

The company isn’t planning to add the kind of extravagant amenities some modern colocation facilities feature – there won’t be a climbing gym or a rooftop garden – but there will be fresh paint, comfortable customer workspace, new office furniture, break rooms, and fast WiFi.

“We will be focusing on core amenities that are important to our clients,” the CEO said.

Evoque management, together with Brookfield, is already weighing various expansion options.

They’re evaluating several “interesting” acquisition opportunities currently on the market, Caufield said, as well as thinking about building new facilities. The goal is to add capacity in markets where the company’s data centers are full and/or in hot markets where it has available inventory but thinks it can fill more. Examples of the former are Atlanta and Tokyo; examples of the latter are Northern Virginia and Dallas-Fort Worth.

“Overseas [markets], I expect, will become a bigger part of our conversation over the next quarter-quarter and a half,” Caufield said.

Return to: 2019 Feature Stories